by Brandon Dante | Jan 6, 2017 | Business Tips, Tax Firm, Tax Tips

Happy New Year! If you’re like most small business owners you’ve probably started to wonder what your tax situation is going to look like this year. Will you owe or will you be receiving a check? What about W2s? Did you forget to save any receipts and when should you...

by Brandon Dante | Dec 28, 2016 | Bookkeeping, Tax Firm, Tax Tips

What do you look for in a tax firm? It’s a simple question, but one that shouldn’t be taken too lightly. You might find the answer by asking a colleague. You could ask the local Chamber or maybe you’ll find the answer by doing a search in Google and going with who you...

by Brandon Dante | Dec 21, 2016 | Bookkeeping, Business Tips, Employment Tips, General Tips, Newsletter, Tax Tips

Inside this issue: Time to Start Thinking About Year-End Tax Moves Cutting the IRS Out of Your Gifts WARNING – Latest IRS Scam Year-End Investment Moves Q and A Tax Calendar

by Brandon Dante | Dec 14, 2016 | Bookkeeping, Business Tips, Employment Tips, Newsletter, Tax Tips

Inside this issue: Time to Start Thinking About Year-End Tax Moves Little-Known Tactic Increases Child Care Credit De Minimis Expense Election Required Before Year-End WARNING – Latest IRS Scam Liberal Expensing Limits Can Create Major Year-End Tax Savings Year-End...

by Brandon Dante | Dec 9, 2016 | Bookkeeping

There comes a time when every business owners needs to decide what to do with their financial books. Will they continue to manage them on their own or will they hire a full-time person to take care of it for them? What about the option of hiring a local bookkeeping...

by Brandon Dante | Dec 5, 2016 | Business Tips, Employment Tips, Tax Tips

If you lost your job this year, we’re sorry that you had to endure this personal and financial setback. However, if you look on the brighter side of things, it’s not the end of the world as you know it. You may now be eligible for some tax credits. This article will...

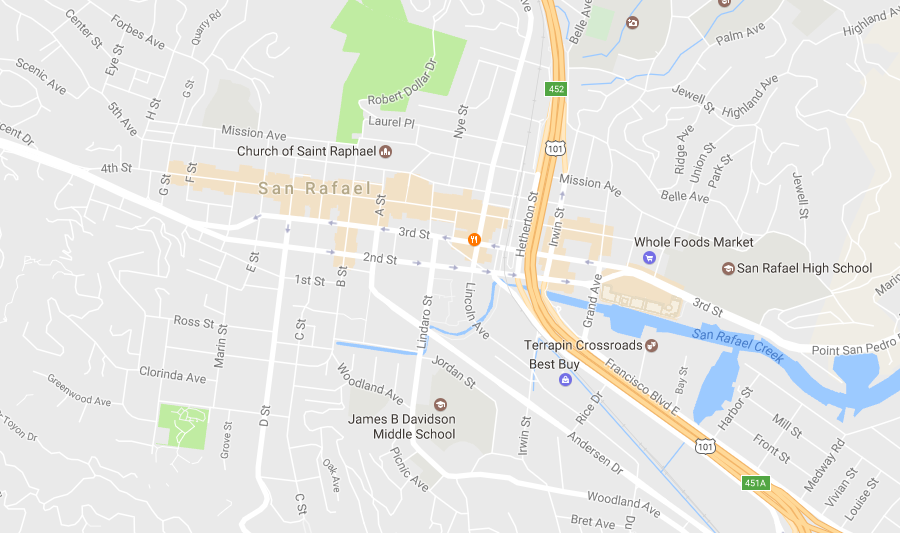

by Brandon Dante | Nov 29, 2016 | Business Tips, General Tips, Tax Tips

For the past 17 years, our clients have hired us to do their taxes for a variety of reasons. Experience, Experience, Experience First and foremost, if you’re looking for an accountant, you want to hire experience. You want someone who had filed thousands of returns...

by Brandon Dante | Oct 18, 2016 | Business Tips, General Tips, Tax Tips

Many small businesses choose to act as their own accountant. In many cases, they take the time to enter all of their debits and credits, manage their Accounts Payable, track their Accounts Receivables, track their vendors, and everything else that you need to do to...

by Brandon Dante | Sep 1, 2016 | General Tips, Tax Tips

Being proactive to lower your taxes is a year-round job. I know it. You know it. But what are you doing about it now instead of waiting until December and you’re out of time? This article offers some helpful tips to be in good shape by the end of the financial year....

by Brandon Dante | Aug 12, 2016 | Business Tips, Employment Tips, General Tips, Newsletter, Tax Tips

Welcome to the Fall 2016 edition of our Client Advisor newsletter. Inside you’ll find current information, news and trends to help your business be better and grow. Inside this issue: Short-Term Rental, Special Treatment Tax Breaks for Hiring Your Children...