by Brandon Dante | Aug 2, 2016 | Business Tips, General Tips, Tax Tips

Benjamin Franklin once said, “Our new Constitution is now established, and has an appearance that promises permanency; but in this work nothing can be said to be certain, except death and taxes.” We know enough about death, but have you ever thought about where your...

by Brandon Dante | Jul 18, 2016 | Business Tips

This article will cover: Primarily Business Primarily Vacation Special Circumstances Foreign Conventions, Seminars and Meetings Cruise Ships Spousal Travel Expenses The Difference Between Business, Vacation, and Business and Vacation Travel When an individual makes a...

by Brandon Dante | Jul 11, 2016 | Business Tips, Employment Tips, General Tips, Tax Tips

Welcome to the Summer 2016 edition of our Client Advisor newsletter. Inside you’ll find current information, news and trends to help your business be better and grow. Inside this issue: Was Your No-Health-Insurance Penalty a Surprise? Big Business...

by Brandon Dante | Jul 7, 2016 | Tax Tips

One of our clients received a call this week from the IRS, it certainly rattled his cheerful, mid-summer mood, but was it really the IRS calling or a scam? The recorded phone message said that the caller was from the IRS, that he owed them money, and that he should...

by Brandon Dante | Jun 1, 2016 | Business Tips, Tax Tips

When the year is nearly over, do you always have an “a-ha moment” when you remember all of the possible tax deductions you could have claimed from our previous meetings, phone calls, and emails? In this month’s article, I’ll share the 7 things you can do right now to...

by Brandon Dante | May 8, 2016 | Business Tips

Many of my new clients often ask themselves, “Why should I hire a bookkeeper for my small business?” It’s a great question and one that has many possible answers. In this article, I’ll explore the most popular reasons why a small business owner would need outside...

by Brandon Dante | Mar 30, 2016 | Business Tips, Tax Tips

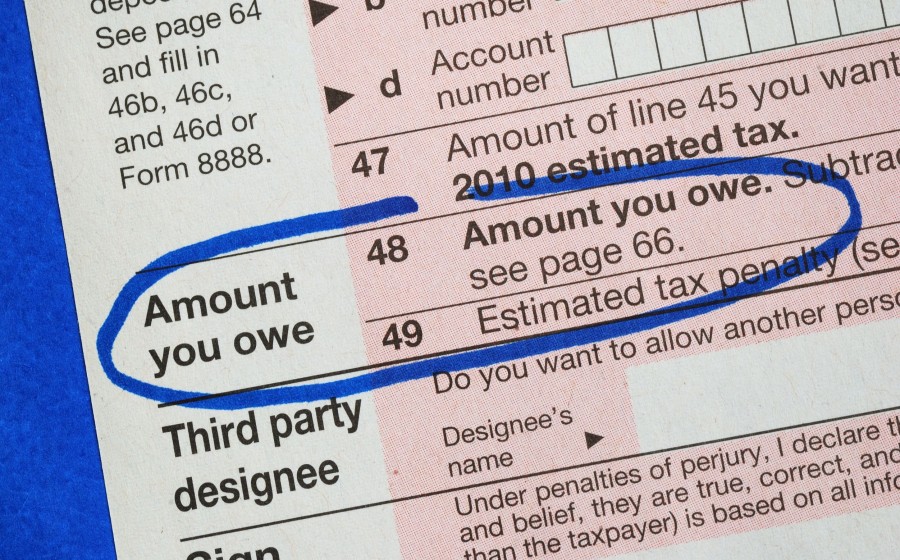

Because April 15th is a Friday this year, April 18th is the official tax deadline for 2016. So if you’re not quite ready to file your taxes by then, it’s time to file a tax extension for your individual tax return. Whatever accounting help you may need, Books in...

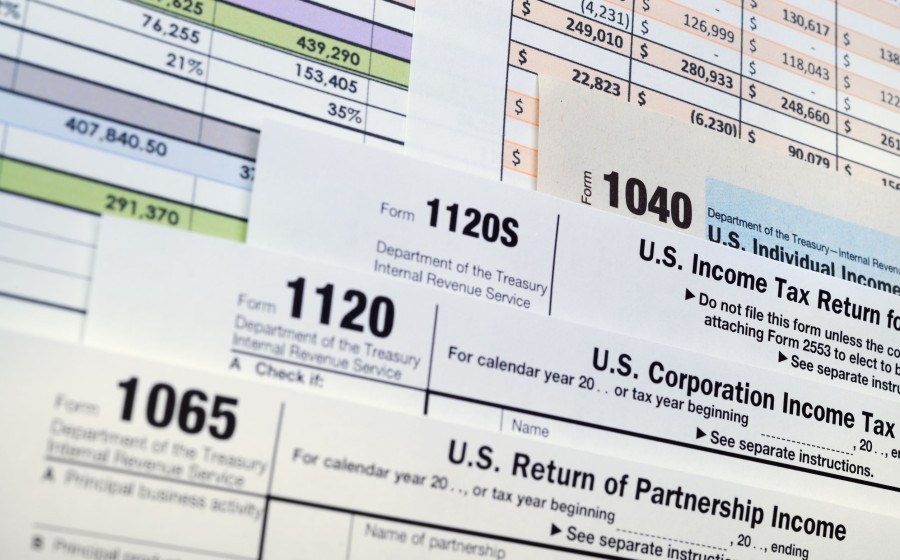

by Brandon Dante | Mar 2, 2016 | Business Tips, Employment Tips, General Tips, Tax Tips

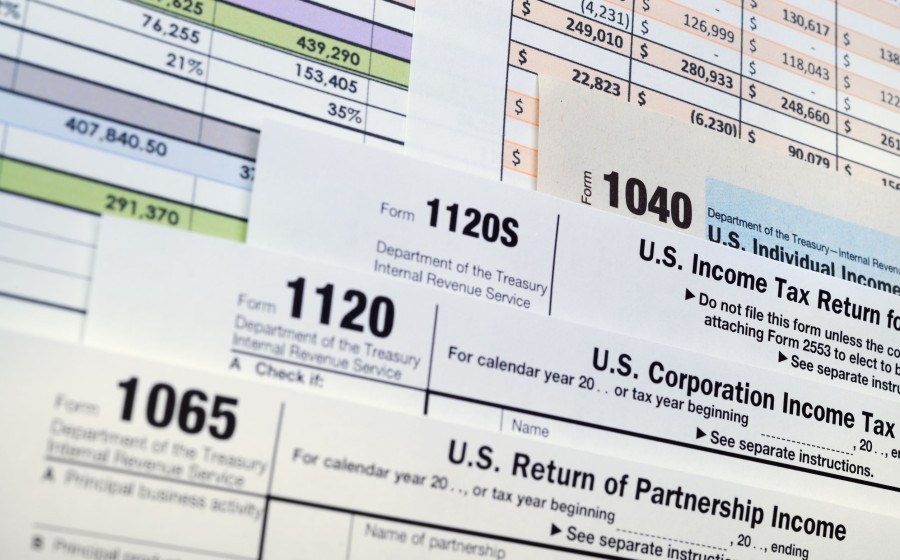

What Self-Employed Business Owners Need to Know Self-employment is growing throughout the San Francisco Bay Area. Many of my clients who have been laid off from a corporate job are exploring a second career that finds them working for themselves. While this is great...

by Brandon Dante | Feb 8, 2016 | Tax Tips

In the first installment of this two-part story, I outlined some of the most salient points of the “Protecting Americans from Tax Hikes” Act of 2015 that was signed by Congress in December. This blog completes the overview of the law, which will have an impact on your...

by Brandon Dante | Jan 28, 2016 | Tax Tips

The “Protecting Americans from Tax Hikes” Act of 2015 was signed into law on December 18, 2015. The law renews a long list of tax breaks known as “extenders” that have been expiring on an annual basis. This legislation makes some of the rules effective...