by Brandon Dante | Nov 9, 2017 | Tax Tips

When people come to my San Rafael office to go over their books, one thing I always try to explain is that my goals focus on clean, thorough, and accurate books. By doing so, I ensure that their records can help us Accounting professionals get them into a lower tax...

by Brandon Dante | Oct 8, 2017 | Bookkeeping

How to Find the Right Bookkeeper for You When you’re hiring a bookkeeper, you’re not just hiring someone to crunch your numbers. You are putting your business and your livelihood in someone else’s hands. Thus, the relationship must be strong and filled with...

by Brandon Dante | Sep 11, 2017 | Business Tips, General Tips, San Rafael, Tax Tips

Identity Tips from A San Rafael Tax Professional When people think about identity theft, they generally don’t consider their taxes as the culprit. Let’s assume you’re just an everyday person — a local resident in San Rafael, like me, working hard for...

by Brandon Dante | Aug 12, 2017 | San Francisco, San Rafael, Tax Tips

A little-known tax benefit for new, qualified small businesses is the ability to apply a portion of their research credit – no more than $250,000 – to pay the employer’s share of their employees’ FICA withholding requirement (the 6.2% payroll tax). This can be quite a...

by Brandon Dante | Aug 5, 2017 | Bookkeeping, General Tips

Even if you’ve been using QuickBooks Online for a long time, it’s good to step back and evaluate your actions. “Best practices” aren’t enforceable rules. They’re simply guidelines businesses commonly follow in one area or another. If you’re in retail, for example, one...

by Brandon Dante | Aug 5, 2017 | San Francisco, Tax Tips

Gambling is a recreational activity for many taxpayers, and as one might expect, the government takes a cut if you win and won’t allow you to claim a loss in excess of your winnings. In fact, there are far more tax issues related to gambling than you might expect, and...

by Brandon Dante | Aug 1, 2017 | Accounting, Bookkeeping, San Francisco

If you’re looking for San Francisco bookkeeping and accounting firm, did you know that the location of the firm you choose doesn’t need to be in The City? The fact is technology has now not only made it easier to have a quality firm looking after your books, but you...

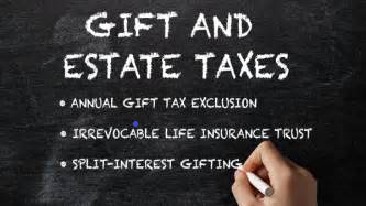

by Brandon Dante | Jul 21, 2017 | Tax Tips

If you are fortunate enough to have a large estate – one large enough to be subject to the estate tax upon your death – you might be considering ways to give away some of your wealth to your family and loved ones now, thereby reducing the estate tax when you pass on....

by Brandon Dante | Jul 20, 2017 | General Tips, Tax Tips

Renting out your home or second home for short periods of time is becoming increasingly popular with the advent of online services that match property owners with prospective renters. The online sites providing these services include Airbnb, VRBO, and HomeAway. There...

by Brandon Dante | Jul 15, 2017 | Tax Tips

The Earned Income Tax Credit (EITC) is a tax benefit for working people who have low to moderate income. It provides a tax credit that is treated like tax withholding: it goes to pay an individual’s tax liability, and any excess is paid to the individual in the form...