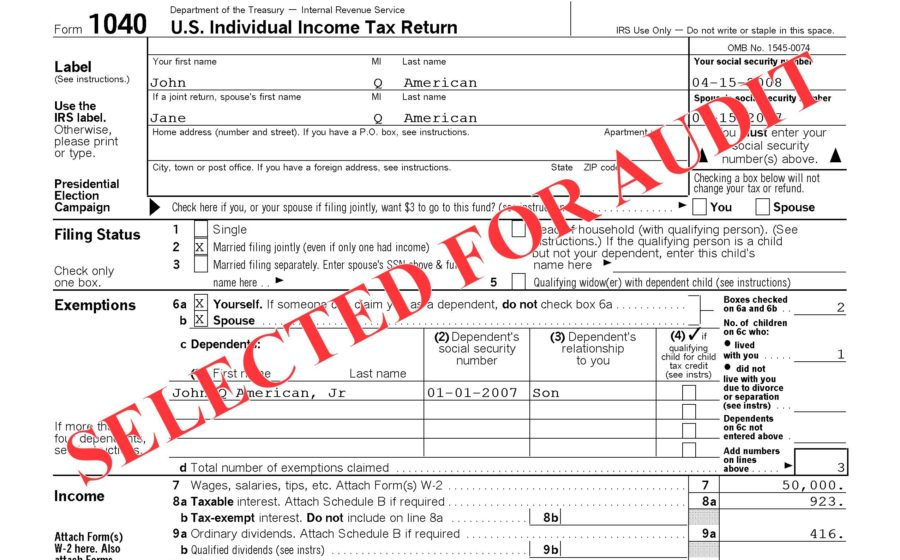

What? Have you done something on your tax return that is one of the IRS red flags that will cause an audit?

That’s not the kind of letter you want to receive. In fact, being selected for an audit by the Internal Revenue Service is one of the worse fears any tax-paying citizen can have.

An audit may have happened to your parents, your siblings, your friends, or your business partners. But it doesn’t have to happen to you.

This article will provide advice for avoiding those red flags that can cause an audit.

The More You Earn, The Likelier an Audit

You’ve probably heard, “The IRS wants to audit the big fish, not the little fish like you.”

But the difference between a big fish and a little fish is how much you earn on an annual basis.

For example, if you’re declaring between $200,000 and $1,000,000, your likelihood of being audited during 2015 was 2.61%. That’s about one in every 38 returns, or three times higher than those earning less than $200,000, which was a mere 0.76% (one in 119 returns).

But if you earned over $1,000,000, you could have a 10% chance of being audited. As we said above, the IRS feasts on the “big fish.”

The good news is that more than 99% of the 140+ million federal tax returns are not ticketed for audits.

What about that remaining 1%? What should I be doing

Did You Report all of Your Taxable Income?

This is one of the biggest triggers for an IRS audit.

If you fail to, forget to, or just don’t report all of your taxable income, you can expect to get a letter from your friends in Washington, DC after their computers match your 1099s and W-2s against your return.

Any mismatch automatically hoists a red flag, so make sure that your amounts match before filing. If not, you’re playing with fire.

Are You Playing It Safe with Your Deductions?

We’ve had many clients who want to deduct just about everything and anything they can to lower their possible taxable income.

The problem is, the more risks you take with deductions, credits and exemptions, the greater your chances of getting audited.

For example, how much do you want to claim in medical deductions, taxes paid, interest paid, and charitable contributions for your particular income range? The IRS uses a computer-scoring system known as the DIF (Discriminant Information Function) to determine what they believe the answer should be for you.

If your deductions in these areas are way out of line compared to other taxpayers in your particular income bracket, the IRS’s DIF may single out your return as one for auditing.

So make sure you check and double-check your deductions against the national standards for these areas: higher income, unreported income, home-based businesses, noncash charitable deductions, large business meal and entertainment deductions (a real red flag on most returns), executive use of your business auto, and large casualty losses.

Losses from activities that the IRS views as a hobby vs. a business are another area of concern. To properly take a deduction for a loss for your hobby, you must be running your activity in a business-like manner and have a reasonable expectation to make a profit, so track your expenses and report them accordingly.

But are You Maximizing Your Deductions?

Though we warn about not taking every deduction, such as 50% of your client entertainment expenses vs. 100%, we do want you to file for all legitimate deductions and tax credits.

Some of our clients have had recent surgeries, which resulted in medical expenses that were double or triple beyond a normal year. We tell them that if their expenses exceeded more than 10% of their adjusted gross income, they can deduct them.

However, if you’re 65 or older, you can use the 7.5% threshold to claim itemized medical expenses through the 2016 tax year.

What About Claiming Your Small Business Deductions?

IRS agents are known to look more closely at a Schedule C form as part of a Federal return because some small businesses take some liberties in claiming deductions.

Among these are claiming a deduction for the portion of your house where your office is located, as well as a percentage of your rent, taxes, utilities, and insurance. These are legal deductions if that room is used exclusively for your business.

And if you run a hair salon, a barbershop, a bar, restaurant, or taxi service, they IRS looks even closer at your net gain or loss.

Are You Making Enough to Charitable Contributions?

Again, the IRS has formulas to compare your charitable deductions with others in your same income level.

So one year, if you suddenly claim $20,000 in charitable deductions when you’ve only claimed $1,000 in the past, that’s a big red flag on your return. If you failed to get an appraisal when you donating a piece of property, or if you don’t file Form 8283 for any noncash donations over $500, those can

become even bigger, redder flags to potentially trigger an audit.

Tax forms with calculator, eyeglasses, pen and sticky note

Are You Claiming a Real Estate Loss?

Rental properties can be great investments, especially because you can deduct the taxes, improvements, homeowner’s dues, and other expenses––up to $25,000 annually against other income.

But the IRS loves to review rental real estate losses, particularly when the taxpayer claims to be a real estate professional even though his or her W-2 may note another business name. That’s just one more red flag that’s just not welcome.

Are You Claiming Alimony Deductions?

If so, the rules are complex. Alimony is deductible if paid by cash or check, but you have to make sure that you and your ex-spouse are reporting the alimony on both returns.

However, child support and noncash property settlements are not deductible. Any variations from these rules can trigger an audit.

Are You Deducting Too Much Entertainment and Travel?

It’s very tempting to want to write-off all of your meals, travel and entertainment expenses, especially if they’re legitimately for your business.

But these are Schedule C line items that are known to regularly cause an audit, especially if it seems higher than normal for your profession. Remember to keep all of your receipts and expense records of whom you met, where you met them, and what you discussed, particularly if the expense was over $75 while traveling.

Are You Claiming 100% of Vehicle Business Use?

We recommend that our clients find a happy medium where they can legally deduct a high percentage of their vehicle’s use for business, but not 100%.

That’s just too high because you typically use your vehicle on weekends or nights––and that’s obviously not always business-related.

If you have a business vehicle, keep track of your fuel costs, repairs, insurance, and maintenance receipts.

Or you can use the IRS standard mileage rates and not claim other expenses. If you’re confused, let’s discuss this deduction.

Are You Taking an IRA Payout?

If you withdraw part of your IRA or 401(k) before you’re age 59 ½, you can be subject to a 10% IRS penalty.

But if you had large medical costs that year, disability, or other circumstances, you may be exempt from the penalty. Again, let’s talk about this if it applies to you.

Do You Now Recognize the IRS Red Flags That Will Cause an Audit?

Now that you’ve read this article and know some of the IRS red flags that can trigger an audit, we

hope that you’ll take this advice seriously. The IRS is not an institution that you want to go toe-to-toe with.

Books in Balance is an agile accounting and bookkeeping firm based in San Rafael. We’ve been providing advice about IRS audits and financial services to individuals and businesses throughout the San Francisco Bay Area since 1999.

We offer everything from accounting, bookkeeping, budgeting, cash flow and financial analyses, to payroll, bill paying, tax preparation services and more for you, your business, and/or your family.

To ask us a question or to make an appointment about how to avoid triggering an IRS audit, please contact us today.

- Preparing Your Tax Documents - February 1, 2024

- Making of a Successful Team Environment - December 31, 2023

- Got a Mistake on Your Tax Returns? - September 3, 2023