Whether you’re switching providers or your staff has grown to the point that you need better management over payroll, it’s important to take the time to vet your potential payroll service.

It may seem daunting at first — after all, not everyone knows the details around payroll — but there are a few basics that can help start the conversation with potential providers.

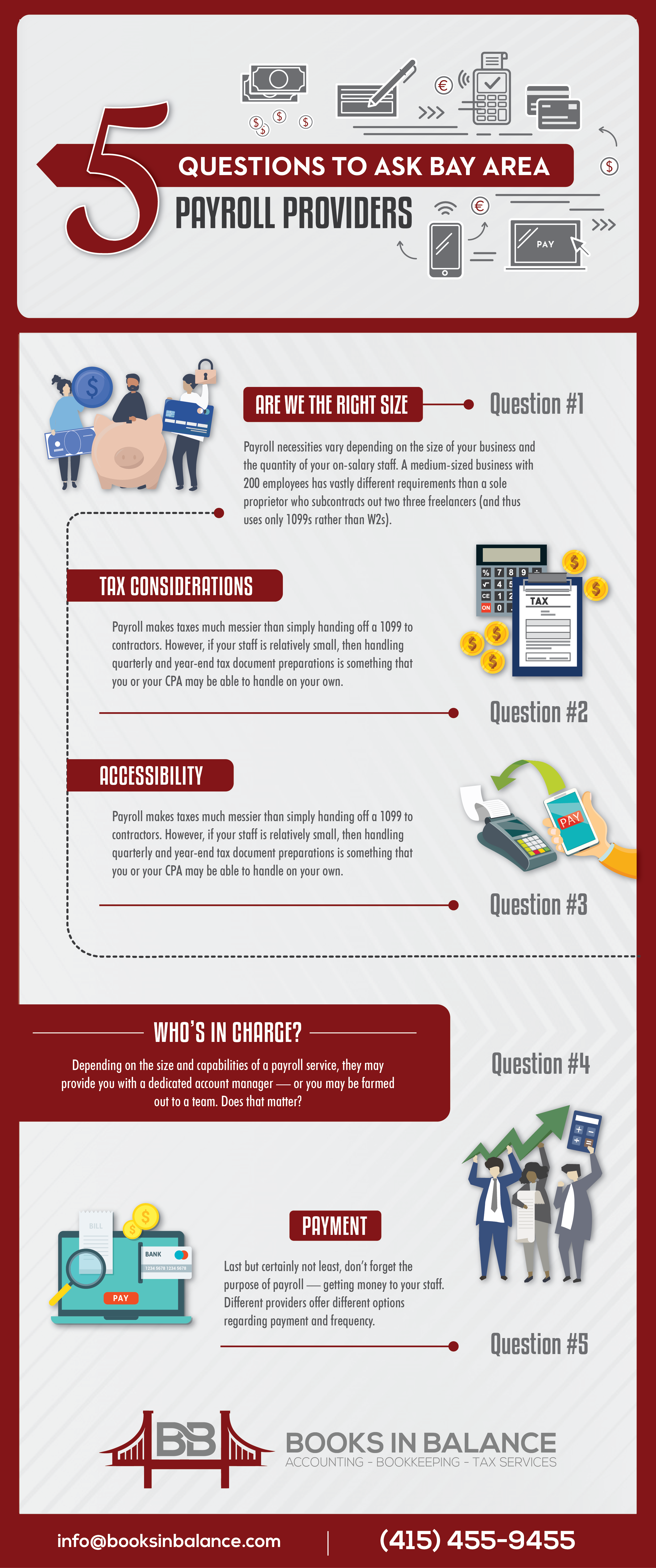

5 Questions to Ask Bay Area Payroll Providers

The following five topics should provide the foundation for understanding what you need from a payroll provider:

- The Right Size: Payroll necessities vary depending on the size of your business and the quantity of your on-salary staff. A medium-sized business with 200 employees has vastly different requirements than a sole proprietor who subcontracts out two three freelancers (and thus uses only 1099s rather than W2s).

Because of that, one of the most important things to ask a potential payroll service is if they are a good fit for a business of your size — and if they do feel like they are a good fit, ask them what approach they recommend given the scope of your business.

- Tax Considerations: Payroll makes taxes much messier than simply handing off a 1099 to contractors. However, if your staff is relatively small, then handling quarterly and year-end tax document preparations is something that you or your CPA may be able to handle on your own.

On the other hand, if you’ve got a staff of at least double-digits, chances are it’s much safer to hand this out to a service. This is something you can discuss with your CPA, though a payroll service provides a more streamlined approach by consolidating the effort to track payroll, deductions, taxes, and tax filing.

- Accessibility: When you want access to your payroll records, do you have to call into the payroll service office and file a request? Or can you open up a mobile app or log into a website to pull up information? And do you care? The answer to this question depends on the size of your staff, the pace of your business, and your own general preferences — while the convenience of always-accessible data is certainly one of the benefits of modern technology, it’s not the end-all/be-all, and some people may even prefer it the old-fashioned way.

Think about what your needs are regarding records and access, then ask a potential payroll provider how they handle that sort of thing.

- Who’s In Charge? Depending on the size and capabilities of a payroll service, they may provide you with a dedicated account manager — or you may be farmed out to a team. Does that matter? As with many of these elements, it probably depends on a number of variables, including how complicated your payroll situation is and how often you think you’ll need to check in.

- Payment: Last but certainly not least, don’t forget the purpose of payroll — getting money to your staff. Different providers offer different options regarding payment and frequency. The standard is direct electronic deposit on a bi-weekly basis, but if you have a larger company, some staff may prefer to get physical checks.

As an employer, you may also want to have the flexibility to change the payment frequency of pay periods. Ask your provider this before you sign up; it’s these little details that often make or break an experience.

San Rafael Payroll Provider

If you have more questions about possibly hiring a payroll services, we encourage you to make an appointment to visit our office. We’re located right on Main Street in San Rafael. Not local? Not a problem, we have clients in all 50 states.

We’re happy to discuss your specific needs — even if they’re not listed above. Schedule your free consultation today by clicking here now.

- Preparing Your Tax Documents - February 1, 2024

- Making of a Successful Team Environment - December 31, 2023

- Got a Mistake on Your Tax Returns? - September 3, 2023