Now that tax season is over, what do you do next?

As a small business owner, whether you received a sizable refund or had to pay Uncle Sam a hefty sum because you had a great 2016, you’re probably relieved that you’ve made it through another year. (We certainly are!)

This article will discuss the needs of our clients – who are small to medium sized business owners – and what you should do now to prepare throughout this year, as well as how to get ready for the next one.

Schedule a Vacation

Just about all of the accountants we know set aside time each year in May or June for a vacation. After all, if it’s time for us to recharge our batteries after the annual tax crunch season that seems to get more pressure-filled each year, you can probably benefit from a vacation, too.

While you’re away from your office, delegate everyday responsibilities to a trusted colleague if you can. We know many business owners who can hand over the reins of their company for times like this.

But if you’re the one running the business, reach out to all of your clients a few weeks before you go away by phone, tell them about your planned time away from the office, and let them you that you’re available by text messages in case of an emergency. Otherwise, let them know that you’ll be back in a week or two to attend to their needs.

Work on Your Extension

If you asked your accountant for an extension of your business or personal 2016 tax returns, now you can take the time to focus on completing the paperwork, even though you have until October to get the returns finalized.

Just collect your W-2s, summarize your possible deductions, review all of your reports, and know that if you’re due a refund, you’ll be eligible to receive it once you file.

Make an Appointment with Your CPA

We always prefer to meet with our clients in the spring or summer after taxes are completed to review our processes and take their pulse on how we’re doing with them.

We ask them to tell us candidly what they liked and what they didn’t like. What could we have done better or differently? What other services are they interested in us offering to them and their families? How will new tax laws affect their personal or business returns in 2017?

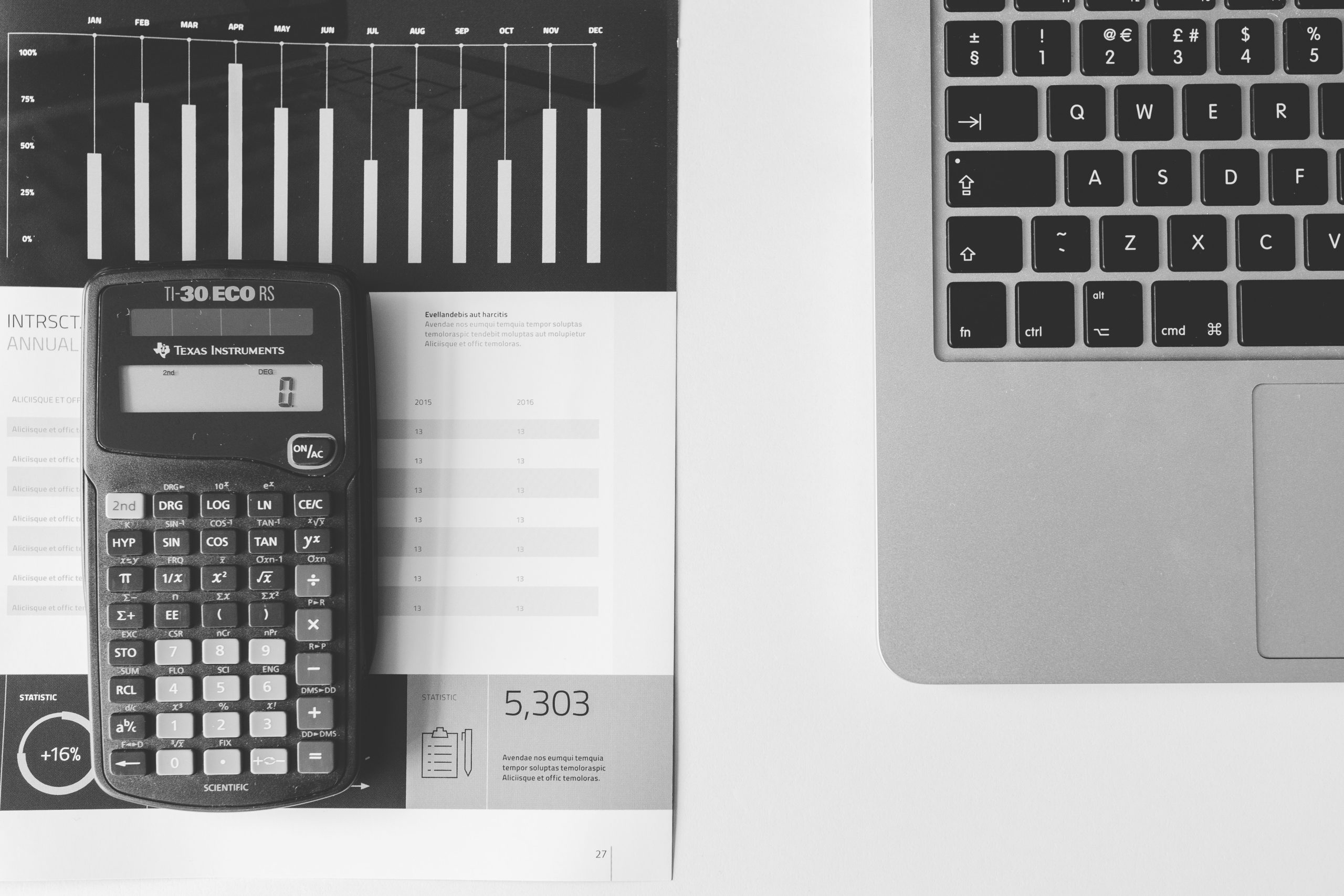

Start Planning for Next Year, Now!

• Do you have a five-year business plan with a cash-flow forecasting, budgeting and cash flow analysis?

• Have you considered what your income might be next year vs. this year?

• Do you plan to hire a few or many new employees?

• What investments in your business can get it to the next level?

• Are there software or hardware investments that you are talking about?

• When’s the last time you discussed financial planning with an expert?

At Books In Balance, we can answer all of these services and more.

Think About Bookkeeping for Your Business

If you’re struggling to keep your business checkbook balanced, don’t know how much accounts receivable you have outstanding at any moment, or are frequently late mailing payments to various vendors and services, it may be time to think about hiring us as your bookkeepers.

Our online accounting software lets you see that your books are solid. We can even help you file 1099 forms for all of your vendors in February each year.

Consider an Outsourced Payroll Service

In addition, whether you have a few employees or dozens, doing all payroll checks and paying payroll taxes can get very complicated very quickly. Books In Balance’s payroll and bill paying services can eliminate the worries of these potential headaches.

Review Your Credit Card Processing Fees

These can really add up throughout the course of a year, especially if you have multiple employees using corporate credit cards. With annual card fees of $50 to $125 or more, you should determine how much you’re spending and look at ways to cut costs with fewer cards or lower fees. We have vendor relationships that can potentially save you hundreds of dollars in credit card fees. We can provide a free quote anytime you want.

Purge Your Old Tax Files

Take the time now to shred any federal tax records and cancelled checks that are at least three years following the date you filed. We also recommend keeping files for up to seven years for your investment retirement accounts. Look for free local shredding events in your area online to purge your old files and buy a fireproof safe to keep the tax documents that you decide to save.

Also, while you’re looking for files to shred, give your office a good cleaning by getting rid of anything you haven’t used in the last few years. This includes books, magazines, newspaper articles, old files, and more that take up space and just collect dust.

Attend Local Events to Network

You never know where you might meet your next employee, a future client, or even your new bookkeeper or accountant. There are a wide variety of networking events held in your city each month, so get out there and attend some.

Start with one event every few weeks until you find a group that resonates with you.

Time to Start Preparing for Next Year’s Taxes

If you have any questions about what to do now that this tax season is over, we’d love to talk to you.

- Preparing Your Tax Documents - February 1, 2024

- Making of a Successful Team Environment - December 31, 2023

- Got a Mistake on Your Tax Returns? - September 3, 2023