If you’ve got an extra Bay Area room or apartment, renting it out on Airbnb can be a great way to make extra cash.

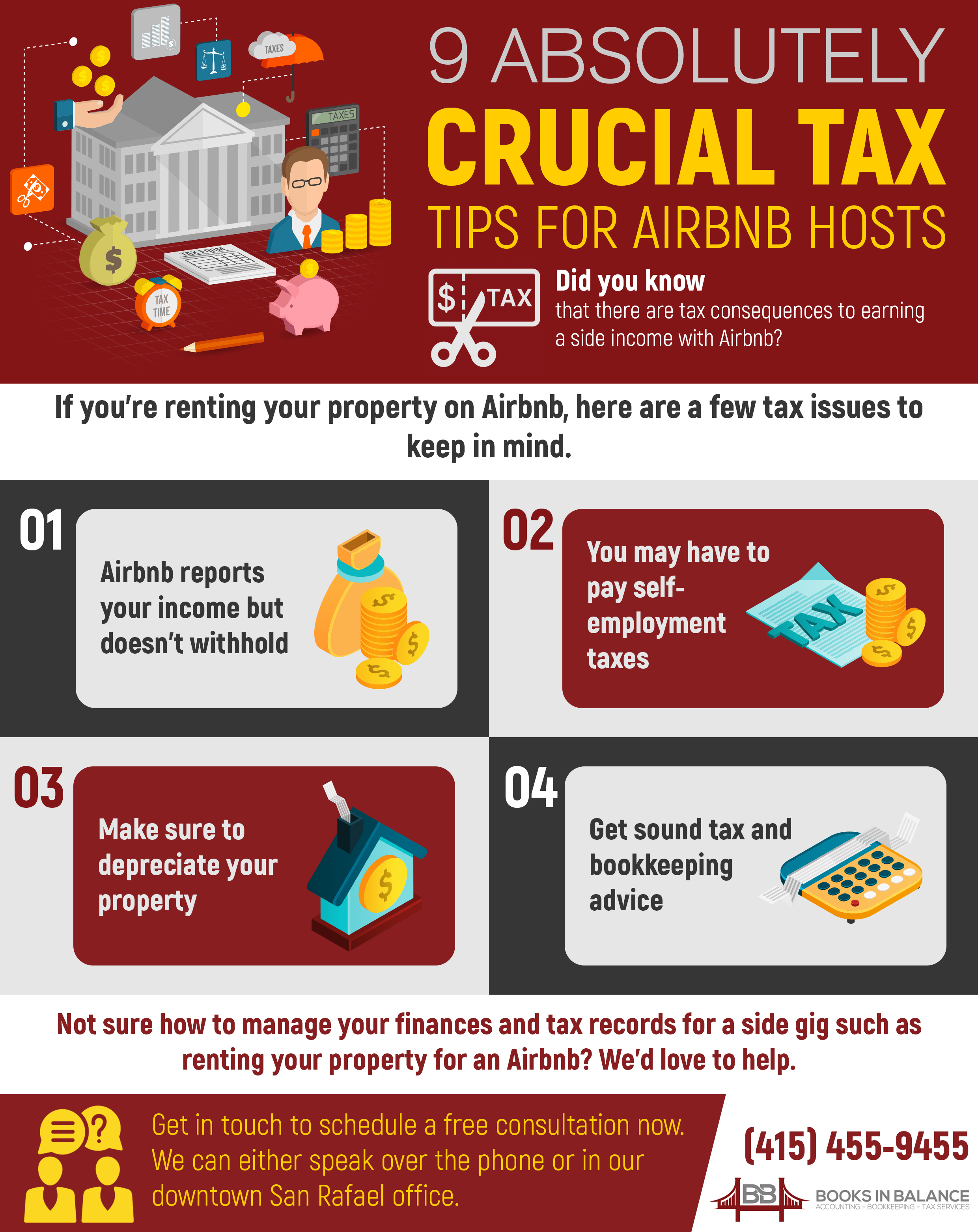

But there are tax consequences to earning a side income with Airbnb.

If you’re renting your property on Airbnb, here are a few tax issues to keep in mind.

1. Some Airbnb hosts don’t have to pay taxes

If you rent out your property for no more than 14 days per year and use the property yourself for at least 14 days, or 10% of the total days you rent it out, you may be exempt from paying taxes for your rental income. But you also can’t take deductions.

This rule applies whether you rent out an entire house or apartment, or just one room.

2. First, report your gross income

When reporting your Airbnb income to the IRS, don’t forget to include the total amount you made that year before service fees, refunds, Airbnb fees, and other expenses are taken out.

3. Then, deduct your expenses

You can deduct any expenses incurred in renting out your space on Airbnb. Some examples include:

• Airbnb fees

• Cleaning and maintenance costs

• Property insurance

• Utilities for the rental property

• Mortgage payments on the rental property

• Furniture and appliances

• Professional photos of the space

4. Airbnb reports your income but doesn’t withhold

Airbnb will request your taxpayer info because it has to report your earnings to the IRS. However, it won’t withhold income as a full-time employer does. It’s up to you to calculate your taxes and make payments.

5. You might get a letter from the IRS

Airbnb will report your earnings even if you rented out your property for fewer than 14 days. But you don’t have to report that income yourself to the IRS if that’s the case. If the IRS spots the discrepancy, they may send you a letter.

It’s no reason to panic, just send them copies of your records proving the number of days you rented your property.

6. You may have to pay self-employment taxes

Self-employment taxes include Social Security and Medicare contributions. When you’re employed full-time, your employer pays a percentage of those; when you’re self-employed, you pay the whole bill.

Depending on your rental income and how you run your rental, the IRS may decide you’re self-employed and expect you to pay those taxes.

This is more likely to apply to you if you’re operating your rental like a traditional hotel, that is, the property is only used for rentals, and you offer other amenities such as breakfast or coffee.

7. Don’t forget about occupancy tax

In some areas, Airbnb hosts may need to collect occupancy taxes from renters. The rules and amounts vary depending on where you live.

Airbnb will collect occupancy taxes for some areas, and will even display the amount on the page for your listing. But in other areas, you have to handle this yourself.

8. Make sure to depreciate your property

Depreciation takes into account the changing value of your rental property. If you’re earning money from your property on Airbnb, you may also be able to write off depreciation for that property.

9. Get sound tax and bookkeeping advice

Not sure how to manage your finances and tax records for a side gig such as renting your property for an Airbnb? We’d love to help.

Get in touch to schedule a free consultation now. We can either speak over the phone or in our downtown San Rafael office.

- Preparing Your Tax Documents - February 1, 2024

- Making of a Successful Team Environment - December 31, 2023

- Got a Mistake on Your Tax Returns? - September 3, 2023