by Brandon Dante | Jun 12, 2017 | Tax Tips

Every summer, my always clients ask me, “Is my kid’s summer camp tax deductible?” And I always reply with a range of answers: “Yes”, “No” and “Maybe”. This article will explain why your kid’s summer camp may or may not be tax deductible, depending on your family’s...

by Brandon Dante | May 12, 2017 | Bookkeeping, Business Tips, Tax Tips

Now that tax season is over, what do you do next? As a small business owner, whether you received a sizable refund or had to pay Uncle Sam a hefty sum because you had a great 2016, you’re probably relieved that you’ve made it through another year. (We certainly are!)...

by Brandon Dante | Feb 10, 2017 | Tax Tips

Every holiday season, you probably ask yourself why you spent so much on buying presents for family and friends, especially when you think of using your tax refund to pay of your Christmas bills. Upon reviewing your credit card bills in late January for those December...

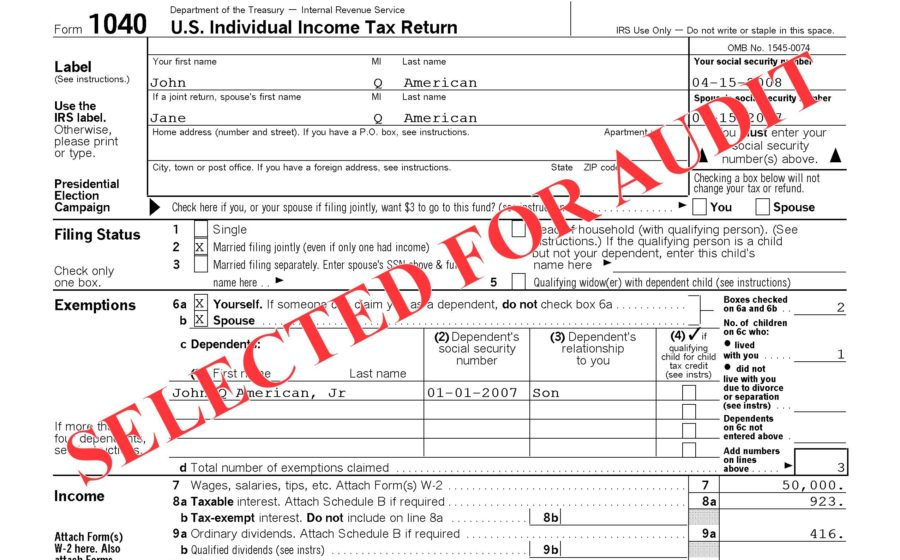

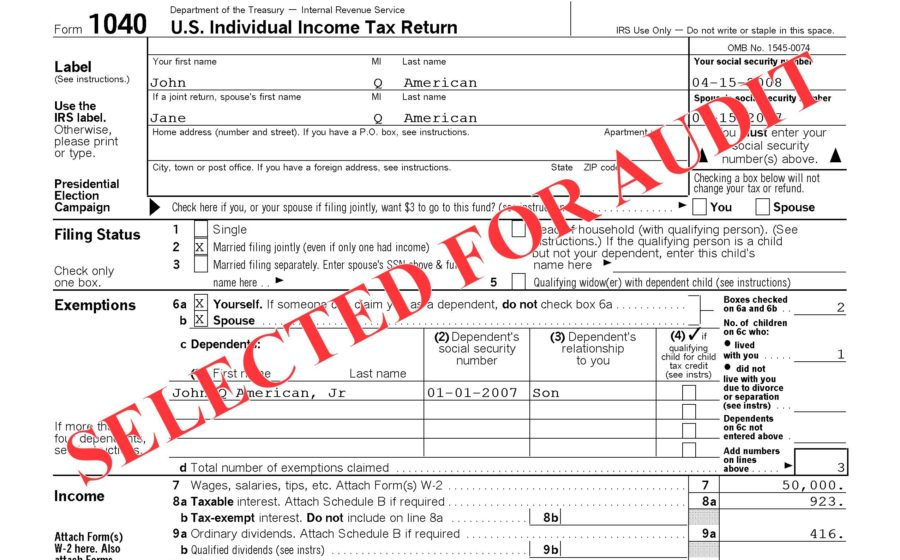

by Brandon Dante | Feb 5, 2017 | Tax Tips

What? Have you done something on your tax return that is one of the IRS red flags that will cause an audit? That’s not the kind of letter you want to receive. In fact, being selected for an audit by the Internal Revenue Service is one of the worse fears any tax-paying...

by Brandon Dante | Jan 17, 2017 | Bookkeeping, Business Tips, General Tips, Tax Tips

Now that your calendar has turned over to 2017, it’s time to start thinking about why it’s important to see your accountant in January rather than later in the year. This article will outline why January is preferable to April, what you need to gather and your next...

by Brandon Dante | Jan 6, 2017 | Business Tips, Tax Firm, Tax Tips

Happy New Year! If you’re like most small business owners you’ve probably started to wonder what your tax situation is going to look like this year. Will you owe or will you be receiving a check? What about W2s? Did you forget to save any receipts and when should you...